Grassfed cattle

MLA works with the Cattle Council of Australia. The grassfed cattle levy is invested in projects designed to increase on-farm productivity, profitability and sustainability of grassfed cattle producers.

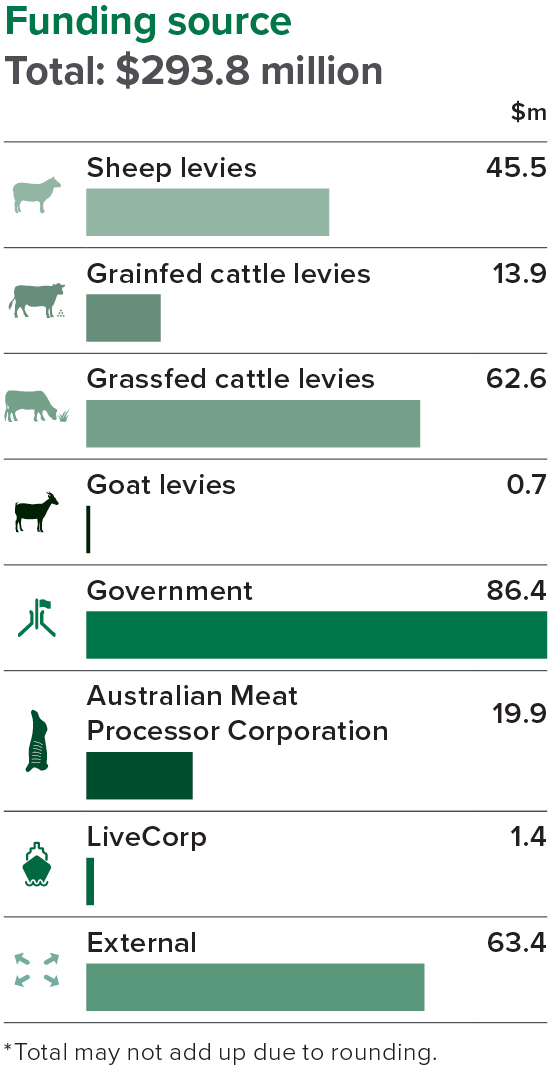

Cattle, sheep and goat producers pay a transaction levy on the sale of their livestock. The levies are collected by the Department of Agriculture and Water Resources’ Levies Service and distributed to MLA, Animal Health Australia (AHA) and the National Residue Survey (NRS).

Processors, lot feeders and livestock exporters also pay levies. A portion of these levies are invested in MLA-managed R&D and marketing projects that deliver cross-sector benefits beyond the farm gate.

MLA works with the Cattle Council of Australia. The grassfed cattle levy is invested in projects designed to increase on-farm productivity, profitability and sustainability of grassfed cattle producers.

MLA works with the Australian Lot Feeders' Association to develop R&D and marketing strategies for the feedlot industry.

MLA works with Sheep Producers Australia to increase on-farm productivity, profitability and sustainability of sheep producers.

MLA works with the Goat Industry Council of Australia, seeking producer input on levy investment and increasing the on-farm productivity, profitability and sustainability of goat producers.

MLA works with supply chain partners on projects that deliver value to the red meat industry beyond the farm gate.

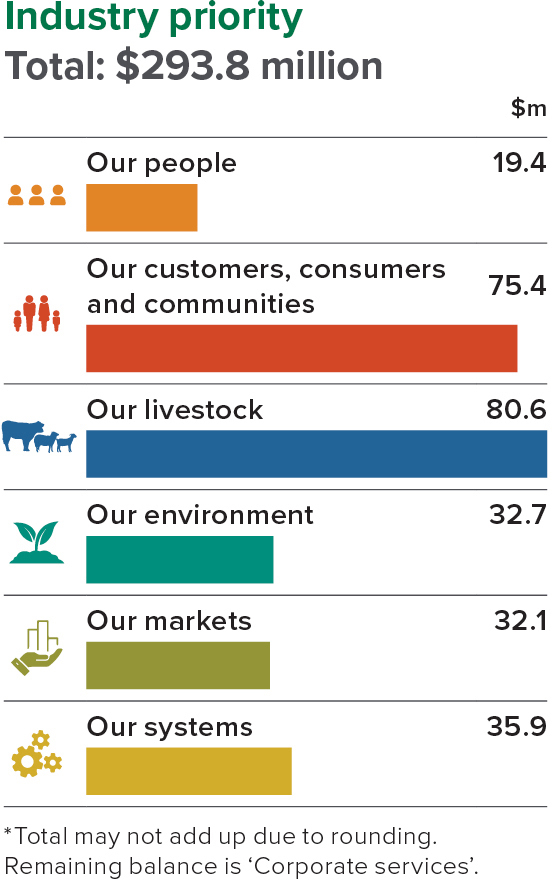

In 2020–21 MLA plans to invest $293.8 million in research, development and marketing activities across six priorities.

The table below shows the split of livestock levies.

| Commodity | MLA (R&D) | MLA (marketing) | Animal Health Australia | National Residue Survey | Total Levies# |

|---|---|---|---|---|---|

|

Grassfed cattle |

$0.92 |

$3.66 |

$0.13 |

$0.29 |

$5.00 |

|

Grainfed cattle |

$1.50 |

$3.08 |

$0.13 |

$0.29 |

$5.00 |

|

Bobby calves |

$0.16 |

$0.48 |

- |

$0.26 |

$0.90 |

|

Sheep* |

0.77% of sale price |

0.87% of sale price |

0.18% of sale price |

0.18% of sale price |

2% of sale price+ |

|

Lambs* |

0.49% of sale price |

1.20% of sale price |

0.20% of sale price |

0.11% of sale price |

2% of sale price ++ |

|

Goats |

$0.167 |

$0.105 |

$0.045 |

$0.06 |

$0.377 |

# per head, per transaction

*Where there is a defined sale price of $5.00 or more (no levies apply to sales of less than $5.00)

+ To a maximum of 20c. Where there is no defined sale price – 20c

++ To a maximum of $1.50. Where there is no defined sale price – 80c

MLA cannot vary the levy schedule.

If you have any questions about how transaction levies work, you should contact your local Department of Agriculture, Water and the Environment Levies office toll free on:

Central Office (Canberra) 1800 020 619

NSW/ACT/QLD 1800 625 103

SA/NT/WA 1800 814 961

VIC/TAS 1800 683 839

Department of Agriculture, Water and the Environment Levies does not hold information on how much levy a producer has paid.

The Beef Levy Review was conducted in 2009 to evaluate the effectiveness of the increased marketing component of the cattle transaction levy since 2006, and to determine the appropriate level of funding for beef marketing and trade development to ensure Australia's beef industry is competitively positioned.

The review resulted in cattle producers voting to maintain the cattle transaction levy at the rate of $5 per head at the 2009 MLA AGM, with 72.5% of votes cast in favour of the resolution.

Find out more about the Beef Levy Review 2009.